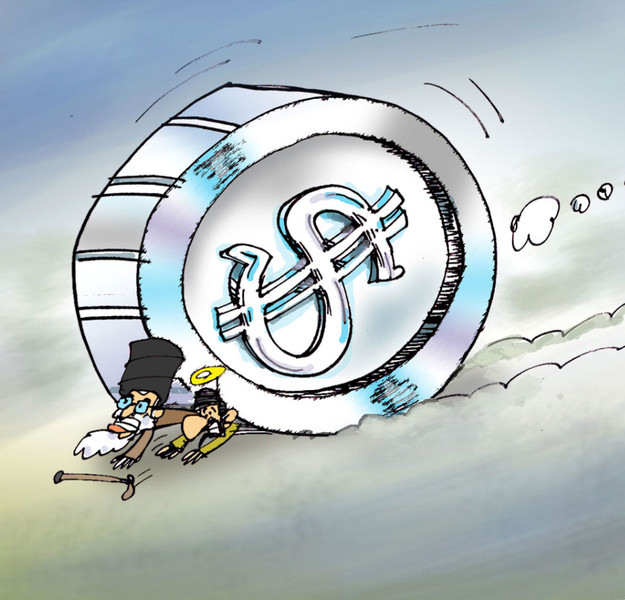

0530 GMT: Last week one of EA's Iranian correspondents, noting the Iranian Rial had fallen below 19000:1 vs. the US dollar on the open market, asked if I thought this was a currency crisis.

0530 GMT: Last week one of EA's Iranian correspondents, noting the Iranian Rial had fallen below 19000:1 vs. the US dollar on the open market, asked if I thought this was a currency crisis.

My preference was for caution. The Rial had sunk 80% between last September and the start of 2012, dropping as low as 22000:1 vs. the US dollar, but Government and Central Bank intervention had brought some recovery, even if it had failed to enforce the official rate of 12260:1. The Rial was boosted to a high point of 15600:1 this spring.

In the last two months, the currency had been slipping, however. Even more importantly, the effects of the instability were being felt in areas such as imports, where higher costs were damaging Iranian industrial and agricultural production. Far from unifying the exchange rate, the Central Bank was pushed to introduce a three-tier system, effectively subsidising "basic" and "capital and intermediate" imports.

So I said to the correspondent, "If the Rial reaches 20000:1, this will be a 'situation'."

This morning, after a 5% drop on Monday --- with reports that the plunge was 8% at one point, with exchange offices refusing to sell US dollars --- the Rial is at 21300:1.

Posted via email from lissping

No comments:

Post a Comment

Note: only a member of this blog may post a comment.